Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

Blog Article

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

Table of ContentsGet This Report about Mileagewise - Reconstructing Mileage LogsThe Mileagewise - Reconstructing Mileage Logs PDFsThe Definitive Guide to Mileagewise - Reconstructing Mileage LogsExcitement About Mileagewise - Reconstructing Mileage LogsFascination About Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs - QuestionsRumored Buzz on Mileagewise - Reconstructing Mileage Logs

Timeero's Quickest Range attribute suggests the shortest driving route to your staff members' location. This feature improves efficiency and adds to cost savings, making it a crucial asset for companies with a mobile workforce.Such an approach to reporting and conformity simplifies the typically complicated task of handling mileage expenditures. There are numerous benefits linked with utilizing Timeero to keep track of gas mileage.

The 7-Second Trick For Mileagewise - Reconstructing Mileage Logs

With these tools in usage, there will be no under-the-radar detours to boost your compensation expenses. Timestamps can be found on each mileage access, improving trustworthiness. These added verification procedures will keep the internal revenue service from having a factor to object your mileage documents. With precise gas mileage tracking modern technology, your employees don't have to make harsh gas mileage price quotes or perhaps bother with gas mileage cost tracking.

If a staff member drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all cars and truck expenditures (simple mileage log). You will require to continue tracking gas mileage for job also if you're utilizing the real expense method. Maintaining mileage records is the only way to different organization and personal miles and offer the evidence to the IRS

The majority of gas mileage trackers allow you log your journeys manually while determining the distance and compensation quantities for you. Lots of likewise featured real-time journey tracking - you need to start the app at the beginning of your journey and stop it when you reach your final destination. These applications log your beginning and end addresses, and time stamps, along with the total range and repayment quantity.

Not known Factual Statements About Mileagewise - Reconstructing Mileage Logs

Among the questions that The IRS states that automobile expenses can be considered as an "common and essential" price in the training course of working. This includes expenses such as gas, maintenance, insurance policy, and the automobile's depreciation. For these expenses to be thought about deductible, the lorry must be made use of for business functions.

Getting My Mileagewise - Reconstructing Mileage Logs To Work

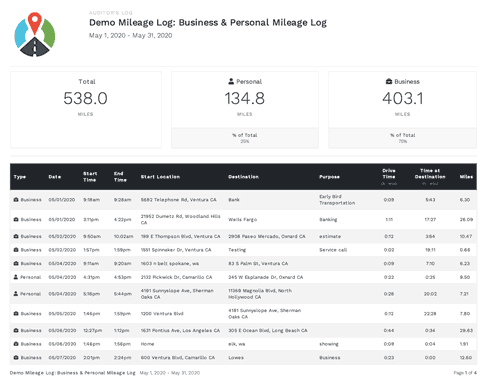

In between, diligently track all your organization journeys noting down the starting and ending analyses. For each trip, document the location and business purpose.

This consists of the complete service gas mileage and overall mileage accumulation for the year (service + personal), journey's date, destination, and purpose. It's necessary to videotape activities immediately and keep a synchronous driving log outlining day, miles driven, and organization purpose. Here's just how you can improve record-keeping for audit objectives: Start with making certain a thorough mileage log for all business-related traveling.

Some Ideas on Mileagewise - Reconstructing Mileage Logs You Should Know

The actual expenses approach is an alternate to the common mileage price approach. Rather of determining your deduction based on a predetermined price per mile, the actual expenditures approach enables you to deduct the real prices connected with utilizing your vehicle for business objectives - free mileage tracker. These prices consist of gas, maintenance, fixings, insurance, depreciation, and other related expenses

Those with significant vehicle-related expenses or distinct conditions might benefit from the real expenditures method. Ultimately, your selected approach ought to line up with your specific financial goals and tax scenario.

A Biased View of Mileagewise - Reconstructing Mileage Logs

(https://mi1eagewise.carrd.co/)Compute your total business miles by utilizing your begin and end odometer analyses, and your taped organization miles. Accurately tracking your specific gas mileage for business journeys aids in validating your tax deduction, especially if you decide for the Standard Gas mileage technique.

Keeping track of your gas mileage by hand can call for persistance, but keep in mind, it can save you cash on your tax obligations. Tape-record the total mileage driven.

8 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

In the 1980s, the airline company sector became the first commercial individuals of general practitioner. By the 2000s, the shipping industry had adopted GPS to track plans. And currently nearly everybody makes use of GPS to obtain around. That means virtually everybody can be tracked as they tackle their organization. And there's snag.

Report this page